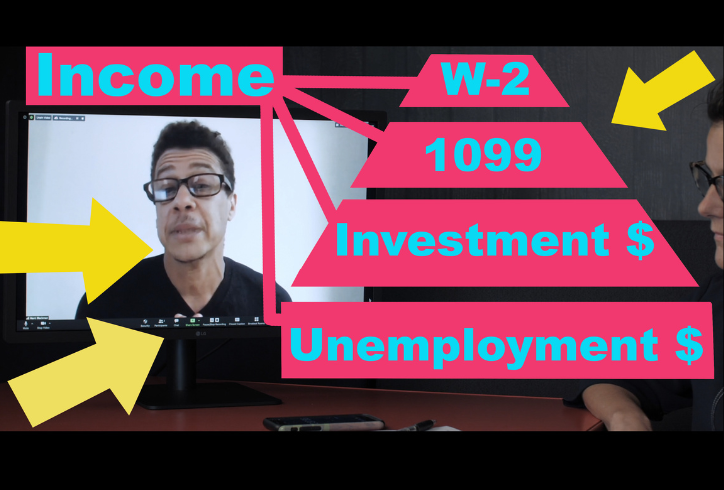

This presentation by Marci Blackman and Diana Y Greiner of Treehouse Taxes provides an overview of the who, what, when, where, and why of the US tax system for choreographers, dancers, and movement artists. Whether you receive 1099, W2, or blended 1099 and W2 income, Marci and Diana will offer information to help performing artists navigate the often confounding and confusing realities of multiple gigs, grants, day jobs to pay the rent, gifts from family members, dog walking, and baby sitting income. Which income is taxable? What does it mean to be self-employed? Can I deduct my cat if I put her in my show??? Marci and Diana will explore some of the most common misconceptions about tax preparation to facilitate an easy introduction to responsible tax filing, more familiarity with self-employed status, and an empowered understanding of how to tackle those *#@&! taxes! The one hour presentation will be followed by a 30 minute Q&A session, so bring your questions!

Accessibility Notes

- This event includes auditive guidance.

- This event includes a projected presentation.

To request ASL interpretation or Audio Description, please email accessibility@movementresearch.org, subject line “ASL/Audio Description Request, Studies Project ” at least three (3) weeks prior to the event date.

For access-related questions and requests, please contact accessibility@movementresearch.org, subject line “Studies Project.”